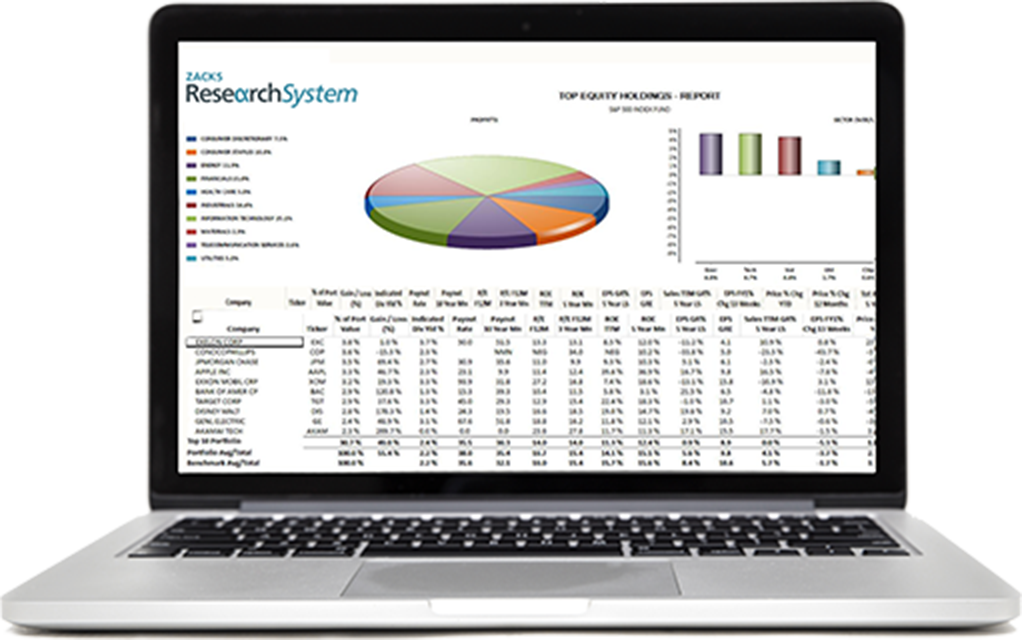

Apply All of Zacks’ Valuable Proprietary Tools

ZRS’s proprietary analytics give you powerful tools to analyze stocks and model portfolios.

Zacks Valuation Model

The core of ZRS is the proven Zacks Valuation Model. It provides a framework for equity pricing that focuses on material issues of relevance and filters out distracting information. So you can stay focused on important drivers of company valuation.

Quantify Any Combination Of:

- Earnings forecasts

- Growth rate forecasts

- Equity risk premium assumptions

- Risk-free rates assumptions

- Company specific quality adjustments

Explore Zacks Valuation Model Output:

- Model PE Model price

- Model forward EPS

- Model return

- Market implied growth